|

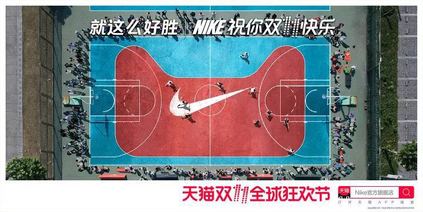

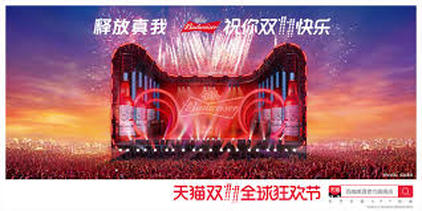

Seeniun Media selected three marketing case studies in China, to showcase the trends and ideas. In Oct, Airbnb sticks to the immersive experience concept and collaborates with the always sold-out show Sleep No More, while Taobao shifts online to offline with a massive campaign for the upcoming 11th Nov Sale. Buick puts the SMART lifestyle under the spotlight while talks less about the car itself in its Utopia House campaign.

0 Comments

You might be familiar with Google My Business, the most efficient tool for local business owner, but it only works out of China. With almost 0.9 billion daily active users, Wechat has become the most important channel for the business to connect with existing customers and provide services due to Google’s being ousted from China. Google My Business is built upon SEO and SEM principle; however, Wechat is more like a combination of a closed LinkedIn group and an APP. Due to it unique model, there are lots of confusion and questions about Wechat service account. What is service account? How to apply innovative approach and enhance CRM via Wechat service account? We study FarFetch and WeWork, and help you sneak peak the functions and potential benefits of the service account for a local / regional business. Service account is designed for better customer services not that much brand awareness. WeWork, the biggest global co-working space operator, uses Wechat to manage the local community and encourage more bookings. FarFetch, the fast-growing luxurious fashion e-commerce platform, fills the gap of the APP and the desktop website via Wechat. WeWork represents a typical local business that requires intense customer support. Its Wechat account provides free Wifi to gain followers from existing and potential members. It enables multiple customer service admin to login, so that customer service team from different cities or locations can handle questions without constant login-and-out. The user can book a tour of a specific location at a specific time, and receive SMS confirmation. They are able to signup the event via Wechat as well. WeWork will also receive a powerful database and analytics from the engagement. On the other hand, FarFetch displays the power of Wechat in e-commerce. The account is integrated with Wechat Pay and Online shop API, i.e. its followers can browse the new collections, order items, complete the order and track the delivery without switching the app. It helps smoothen the user journey and increase conversion, and also guarantees a higher open rate compared to subscription account and the individual APP. The verified service account also allows inserting the external links. It can generate the traffic for websites or a campaign destination, and enables a shortcut to the archive content. FAQ – What’s the difference between wechat service account and subscription account? Location: All the subscription accounts live under the single folder in the news feed, which means user need to two clicks to read the content. Each service account is an individual account, which means higher open rate and strong loyalty. Frequency: Subscription account has the capacity to post or schedule one post a day, which can be one hero post or multiple posts. Therefore, it is used to build the brand awareness. The service account is limited to four posts a month. One thing to note that both service and subscription account require Chinese business license and relevant files for account verification so as to customize the Wechat menu and functions, Selenium Media can customize your service account and apply for account verification on your behalf.

Wechat launched another key function, Mini Program, in early 2017. Mini Program, like a mini APP within the Wechat APP, enables more imagination and flexibility from the developer. Therefore, what’s the limitation of service account, and what’s difference between service account and mini program? Shanghai is one of the first cities that “try the crab”. Registration with ID card, Scan the store QR-code, then scan whatever you want from the shelf, then click check-out with mobile payment directly before walking out of the store – four steps to do the shopping without staff involvement. The unmanned retail has been The first impression entering the store is that you can find almost everything there. Instant noodles, freshly made lunch and chips…the first sight makes not much difference of Bingobox compared to the popular FamilyMart. FaimlyMart defeats its competitors by offering a wide range or freshly made food, from sandwich to sushi, while Bingobox introduces the fresh food concept for those white-collars and also explores a new angle. It brings in more imported snacks, as well as updates the shelves with the bestsellers on Taobao. Therefore, the online shopping momentum is passed down to offline and creates more buzz. 24-hour-convenient-stores can be found at each street corner partially because of the long working hours. The staff cost and pressure for night shift of these ubiquitous convenient stores are the main drive and opportunity for the staff-less stores. With the optimised logistics and inventory management system, the cost is expected to be 10-15% lower than the normal convenient stores. It saves not only the staff cost, but also the costs in the logistics and inventory. If you go to Bingobox now, you can still see a few staff in the store, teaching clients about the process. Some small details are designed carefully and touch many users’ soft spot: Bingobox provides free Wifi and mini-bookstore. Amazon’s collaboration with Bingobox might enable the dying traditional bookstore business a new idea. Bingobox store is slightly bigger than the normal convenient store. Some stores semi-separate a small Amazon-branded space with two or three tables, around which there are 20-30 books. After scanning QR code, you can either buy or rent the book. As long as you purchase the 98RMB annual membership and return the book in 72 hours, you can read as many books as possible for free. The semi-separate area is also a lifesaver for a lot of people who look for a comfortable area with free wifi to rest or work for half an hour without having to pay for an overpriced Starbucks coffee. China retailer has given us inspirations on how to integrate retail into the digital era. The experience can't be copied, however, the lessons can be learnt.

If you want to learn more about the digital trends, and how to develop a plan for the China market, we are experienced and highly skilled to tailor a digital solution for you. Talking about video hosting sites, Youtube is the solo mass-market player without question in spite of the challenge from Vimeo. However, the video landscape in China shows a different picture. Youku/Tudou, Tencent Video and IQiyi split the market and compete fiercely on the audience and revenue in the past few years. In 2012, Youku, at that time the biggest video site, merged with Tudou, kept its traditional advantage on self-made videos and has grown steadily ever since. But they didn’t expect the fast growth and direct competition from IQiyi. The video content online shifted from self-made videos, to purchased TV series, and now towards self-made shows. The revenue model changes accordingly. In the old days, those ideo sites only benefit from the traffic and ads income. When the video sites invested in exlcusive TV series competing with traditional TV stations, membership subscription starts picking up. Audience also becomes more comfortable with the ideas of paying for high-quality content and skipping the long compulsory ads. IQiyi, focusing on purchasing top TV shows and broadcast rights at the beginning and now growing its territory in self-made show, announced that its members are over 20 million in 2016, i.e. the revenue from membership subscription is equivalent as the one from paid advertisement. Another wave of change came this year. The derivative products from the shows or TV series see a strong growth. Audience tends to extend the discussion of the show to the reality. Mobile games, aligned with TV series characters and story background, and collaterals with the show’s elements, which can vary from food to cosmetics, are the most common and well-received ones. Bilibili stays outside of the battle of the Big Three and continues growing among the young generation. Tan Mu, its key feature, allows the comments fly across the screen while people watch the videos. It motivates people to comment more and laugh over others’ comments. The high engagement from Tan Mu feature brings in a new revenue source for Bilibili other than VIP members and traffic for ads. KFC’s successful live broadcasting campaign on Bilibili pointed out a new direction for the integrated campaign - The copy is customized for the audience, two platform hosts in Japanese maid costume are invited to live broadcast them eating 50 pieces of fried chicken. For 15min session, the video received 190,000 views and over 3000. Therefore, if a brand wants to enter the video site, Seeniun Media’s suggestion is as below:

Seeniun Media, a full advertising agency with focus on China, will help you produce video that suits Chinese audience, as well as launch video ad campaign in China. Contact us now! Weibo, once the biggest social platform in China but stuck in big challenges 4 years ago , now comes back to the top player group after four years of hard work. Let Seenium Media dig into its high advertisement revenue, trending hashtags and topics, and increasing micro- influencers, to see the secrets behind a successfully transferred brand. Weibo, known as “Chinese Twitter” global wise, was once the biggest the social platform in China before 2013. In 2013, it encountered a big crisis that almost killed the company and value proposition, when the government, for the sake of sensitivity, blocked some top KOLs and largely discouraged the different voices. In April 2014, Weibo went public. It was said that Wechat would replace Weibo in no time because it lost the core assets – the celebrity KOLs. However, the stats from Weibo in 2016 shows us an inspirational story. It has 0.15 billion daily active users. Weibo’s total revenue grew 70% year-on-year in 2016, meanwhile, the profit jumped by 180% in the same year. Weibo grows to almost twice Twitter’s value, while Twitter is suffering from an inevitable decline. The success of Weibo reflects the massive changes in the social ecosystem happened in China. Three years ago, text and up-to-nice pictures were the dominant content formats, however, videos and live broadcasting by the celebrities, social influencers and medias changed the game plan. Weibo provided the live broadcasting platform, which enabled the existing brand users to run their own campaign with Weibo’s support on trending hashtags and ads. Weibo also captured the social phenomena, such as “315 Consumer Day” and collaborated with traditional TV to integrate the channels. One of best example is Weibo’s collaboration with CCTV New Year’s Gala. It brought the offline traffic online and also generated heating discussion under the same topic. The user stickiness increased by 37.1%. Another example is the Weibo live broadcasting and online engagement during Rio Olympics in 2016. Over 22 billion audience watched the live broadcasting on Weibo, while Olympics related videos were viewed for over 1 trillion times. Many athletes became famous, such as Zhang Jike who was sponsored by Dubai from 2016 to 2017. Three years ago, Weibo was the battlefield of the big KOLs, now it seeds the micro-influencers into sub-category and encourages them to position themselves. After the government blocked a few celebrity influencers’ accounts, the influencer ecosystem shifted to micro-influencers. Weibo developed 55 categories to “cultivate” influencers who have niche audience but also high conversion and engagement rate. Like Youtube, Weibo aim at more than bringing traffic to influencers but expanding distribution channels. Therefore, Weibo launched the vertical multi-channel-networks (MCN) plan. Weibo no long gets involved in the business development and operations for the influencers.

Those who didn’t drop Weibo and embraced Wechat four years ago are now attracted by the new format and content. The Weibo users from tier one and two cities remain, while the new users steadily come from tier three and four cities. Those between 16 and 25 are the core users of Weibo, making up of almost 70% of the whole users. Weibo focuses the product feature on the networking function only instead of invading messaging function. Weibo started with copying the features from Twitter and built itself into a news-oriented fast consuming social platform. Throughout the years, the product positioning has been changed. Weibo caught the latest trends, successfully walked away from Twitter’s old track and developed a new business cycle. |

Services |

Company |

|

RSS Feed

RSS Feed